During your working years, a key financial goal is to save money and grow your net worth. This nest egg funds retirement, emergency spending, and big purchases along the way such as homes, weddings, and educations.

When we retire, we must make a mental shift as we start to spend down our savings and watch our net worth deplete over time. This "de-saving" can be a difficult psychological adjustment as we fear running out of money before we run out of time.

It's challenging because we don't know our future:

expiration date

uninsured medical and nursing expenses

investment returns

optimal spending level, even if we knew the answers to 1, 2, and 3

How do you solve this quandary? You don’t.

But, here are ten suggestions to manage the financial risks you face:

1. Know your income.

Include all remaining income sources — Social Security, pension, annuity, part-time work, etc. — and understand if they're going to change over time. For married couples, understand how these income sources will change once the first spouse departs this earth. Also, focus on after-tax income as that’s what matters.

Note that distributions from your pre-tax retirement accounts are not income. Instead, think of these as forced transfers from your IRA to your taxable savings that allow the IRS to take their due along the way.

2. Track your net worth.

Ignore your home (you need a place to live) and reduce the value of pre-tax retirement accounts by an estimate of the amount of future taxes you'll owe. The nominal value of these accounts overstates what's really yours as part of that will go to future tax payments you're temporarily holding for the government.

Track this "after-tax" net worth over time and you'll get a sense of the rate of depletion and how much cushion you have.

3. Track your spending.

Determine and record your total monthly spending. Have a sense of how it divides into mandatory versus discretionary so you know how much leeway you may have. Do not track categories; instead, just focus on the total.

As I often say, create the world’s simplest spreadsheet — column A is the month and column B is your total spending. This can give you a lot of insight over time and isn’t hard to do.

4. Have a monthly spending target.

The challenge is to neither under- nor over-spend; easy to say but hard to do. This is especially true in the earlier years of retirement when your health is at its best and you want to do stuff. There are different approaches to arrive at an appropriate target and a financial planner can help with this analysis.

5. Be realistic about your life expectancy.

If you're a healthy married couple at age 70, it’s likely that one of you will be around in 20+ years. You still have a long time horizon.

6. Optimize your investment strategy.

You can't control future returns, but you can ensure your investments are well-diversified, low-cost, tax-optimal, have an asset allocation appropriate for your circumstances, and are simple enough for you to understand. Small differences in these variables can have large effects over time.

7. Re-assess over time.

Check in on whether your net worth is where you believe it should be as your age and circumstances change. If not, re-set your spending target to get back on track.

8. Annuitize part of your savings.

A simple lifetime annuity can be a sensible choice in many circumstances, especially if your life expectancy is above average. One approach is to purchase enough of an annuity to cover your mandatory spending, when you take into account your other after-tax income.

Everyone is in favor of an annuity until they discover that you have to give up a significant amount of savings to purchase it and no one gets it back if you die early. However, this "longevity insurance" can be valuable if you're lucky enough to live a long life (see #5 above).

Curious about annuities? You can read a fuller explanation here.

9. Prepare for losing your marbles.

While you’re still fully sentient, think about what and who would be best for you when you lose your marbles. For your financial accounts, you have options such as limited and full agents, trusted contacts, and a future power of attorney that would only spring into action when the time had come. No one is perfect for these roles but it’s likely that someone is better than no one.

No one wants to think about this stuff now. But if you wait until it happens, well, it’s too late to do anything about it.

10. Lastly, embrace this new phase of your life.

Get a dog or a new hobby; try yoga, pickleball, or bridge; teach ESL to new immigrants; spoil your grandchildren. Any of these activities will help you embrace that it’s OK to begin to spend down your savings and understand you’re shifting gears into the de-saving phase of your life.

Not only have you hit your peak net worth but, you’re also not getting any stronger, smarter, healthier, or better looking. It’s OK, I guess.

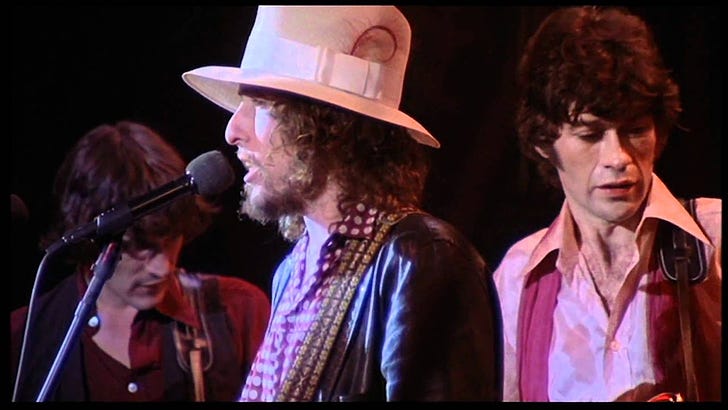

Now, focus on staying forever young.

Great column Jimmy. As usual, pithy, informative and humorous. Rika alerted me to it so it's hitting the spot among your retired readers. Also loved the musical footnote. Thanks also for your recent Palestinian column - much appreciated that you used your platform to speak out for the silenced.